Written by Simone Jones on Thursday 9 March, 2017

Verifying the identity of a customer can be as gloriously simple as meeting a customer face-to-face and taking a copy of their original passport and a utility bill. On the other side of the customer due diligence (CDD) spectrum, is trying to unravel a complex corporate structure and understanding the identity of the ultimate beneficial owner.

The 2016 Panama Papers revelations highlighted issues that anti money laundering (AML) professionals were acutely aware of: complex structures based in offshore tax havens exist and they are often set up in ways which seek to make the identity of the beneficial owner hard to establish.

With this in mind, I want to explore some of the challenges that AML professionals in financial institutions face.

Who are beneficial owners?

Fundamental to carrying out CDD on any legal arrangement is understanding the ultimate beneficial owner. The Financial Action Task Force (FATF) defines a beneficial owner as:

The natural person(s) who ultimately owns or controls a customer and/or the natural person on whose behalf a transaction is being conducted. It also includes persons who exercise ultimate effective control over a legal person or arrangement.

FATF elaborates further:

Reference to “ultimately owns or controls” and “ultimate effective control” refer to situations in which ownership/control is exercised through a chain of ownership or by means of control other than direct control.

Identifying the beneficial owner

Imagine that you are in a role that requires you to carry out CDD and know your customer (KYC) requirements.

The relationship manager has provided you with the file of a potential new client, and stressed how lucrative this account will be to the business. Your initial assumption is that the account shouldn’t be too complex as it’s a UK company.

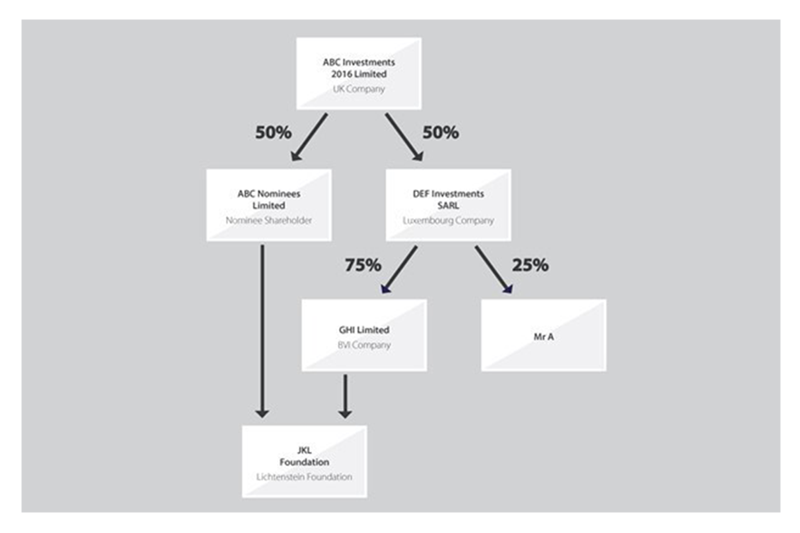

A search on the Companies House website states that the shareholders are a nominee company and a company incorporated in Luxembourg.

Has the beneficial owner been identified?

No, because you still do not have an understanding of who the natural person is behind this structure.

As you review the file further, you see a copy of the nominee agreement, showing the ABC Nominees Limited holds the shares on behalf of JKL Foundation, based in Lichtenstein.

You also can also see the ownership structure of DEF Investments SARL, and you have established the first natural person in the ownership structure, Mr A.

The complete picture?

By building on the information you have obtained, you have added to the structure chart.

The relationship manager has obtained identification documents for Mr A and is happy that this now completes the file as he has been assured that ABC Investments is Mr A’s company.

Is this enough?

Not yet, because you haven’t established that Mr A ultimately owns or controls over 25% of the shares of ABC Investments 2016 Limited or who owns and controls JKL Foundation.

And there are other aspects of the CDD process still to explore, such as the rationale for the complex structure, the nature of the businesses and the source of wealth and funds.

Complex structures

This scenario attempts to illustrate on a small scale how complex company structures can be. In reality there could be many further layers.

Setting up complex corporate structures is not illegal, and most aren’t set up with ill intent. However, it is key to recognise that their very nature can leave them open to misuse for illicit purposes. When complex structures start mixing with jurisdictions that require less transparency or with tax havens, the water starts to become very murky indeed. Invariably it is the responsibility of AML professionals to attempt to unravel these structures.

_________________________________________________________________

How can ICA help?

We provide practical training and qualifications in AML, KYC and CDD and financial crime prevention, from introductory certificates to diplomas and post graduate diplomas.

The ICA Certificate in KYC and CDD provides a foundation knowledge of core know your customer (KYC) and customer due diligence (CDD) concepts, an introduction to CDD frameworks and an overview of the key components of working in the KYC environment.

The ICA Advanced Certificate in Practical CDD explores all aspects of the CDD process, looking at complex structures in detail, assisting students to understanding who the customer is, how to identify and manage customer risk to even creating a KYC file.

We can also deliver bespoke training in-house to firms, allowing you to maximise your budget, minimise disruption and tailor the content to your specific needs.

_________________________________________________________________

This article forms part of the #BigCompConvo - Join us as we explore and debate the latest challenges and issues facing you and regulatory and financial crime compliance professionals all over the world. If you’d like to contribute an article as part of the Big Compliance Conversation get in touch with us at contributions@int-comp.org