Written by Jason Morris on Monday 13 December, 2021

Reporting suspicious activity is a vital part of the fight against money laundering and financial crime. It’s the process that alerts law enforcement to potential criminal activity, providing critical evidence in any investigation.

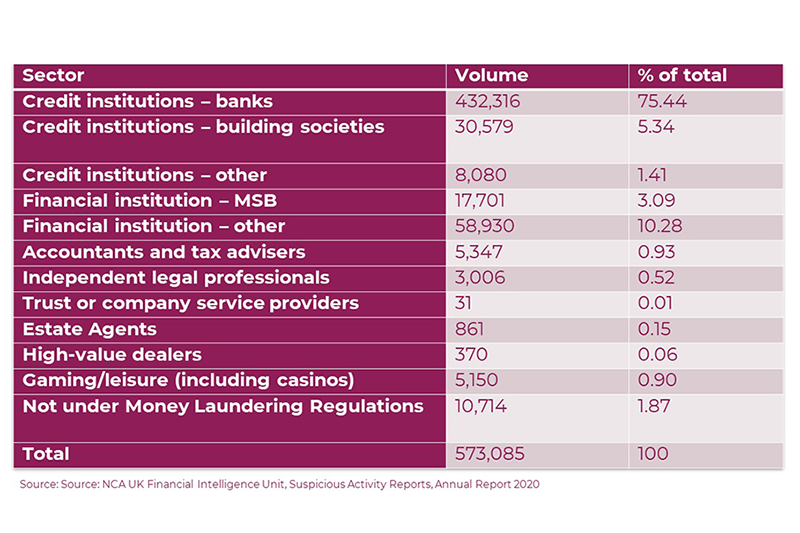

The UK Financial Intelligence Unit (UKFIU), the body to whom all UK Suspicious Activity Reports (SARs) are submitted, is the National Crime Agency (NCA). In 2019/20, it saw a record number of SARs, receiving and processing 573,085, a 20% increase on the previous period.

The vast majority of these were submitted by credit institutions, such as banks and building societies. Very few SARs were submitted from the service sector, such as accountants, lawyers and estate agents, sectors which are in a great position to identify the sorts of behaviours associated with suspicious activity.

The numbers in this table, taken from the NCA’s SARs Annual Report 2020, illustrate just how few SARs are made by the service sector. It’s an area where opportunities to identify key players in criminal activity are being missed, so are these sectors doing enough to curtail this problem?

The banking sector is responsible for the vast majority of reports made. Their systems focus on the financial transactions they administer, highlighting those that either breach pre-determined thresholds or involve regions or individuals known to be associated with money laundering or terrorist financing activity. For service sectors like lawyers and accountants, focus should be more around client behaviours. When you consider the vast client base these professions are involved with, one might expect exposure to more episodes of suspicious activity than are suggested in the number of SARs submitted.

The low number of reports submitted has not gone unnoticed. Lawyers and accountants have been singled out in the past by the NCA for not submitting enough SARs, and it’s not just a UK issue, with the Financial Action Task Force (FATF) also drawing attention to the gulf in reporting from these professions.

SARs and the service sector

But what can the service sector do to address this issue? Knowing your clients is crucial, and that applies to them as individuals as well as a business. By knowing your clients well, firms can recognise associated patterns of behaviour and occasions where this behaviour becomes irregular or unusual. Perhaps the client has taken on a new account for a particularly demanding customer, or maybe they’re operating in a new jurisdiction. If these are driving behavioural change, then more vigilance needs to be applied to activity around these areas.

A client may also provide accounts, or other documentation, that is either incomplete or doesn’t contain clear references or identity documents. Maybe when challenged, the client makes excuses to delay the provision of this information. Or perhaps they simply refuse to provide it at all. This is another potential warning sign that something isn’t right. If this happens, the obvious question is, what are they trying to hide?

This could lead on to an attempt to coerce or bribe you in order to make the problem go away. This should raise questions around the honesty and integrity of the client, and, again, prompt you to consider what they are trying to hide.

Part of the issue, I believe, is that the service sectors rely heavily on the banks and building societies to identify and report any activity that is deemed to be suspicious. Overall, I don’t think they view it as a fundamental obligation of their own activity. This mindset needs to change, and this can be done through industry focused training that looks at the likely money laundering risks associated with the clients of lawyers/accountants/estate agents, etc., and the controls that can be introduced to alleviate these risks.

Guidance was issued by The Law Society in June 2021 on suspicious activity reporting to inform all firms, whether working in the regulated or non-regulated sector, of their obligations. Fundamentally, if you know or suspect that money laundering is taking place, you must make a SAR.

It’s important to note that not all suspicious activity will be found to be criminal, in fact, quite a bit of it is likely to be perfectly legitimate. This doesn’t mean, however, that it should not be reported if your suspicions are well-intended. It may be a crime not to report it, so it’s a delicate line to be walked. But having the courage to raise your concerns is key to stopping money laundering. Increasing reporting in the service sector will, undoubtedly, result in more criminal activity being thwarted.

If you work in the service sector and have concerns around how suspicious activity is managed at your firm, speak to your money laundering reporting officer (MLRO) about how this can be addressed. Extra training is an excellent way to bring SARs to the attention of all staff within the company and may result in much more money laundering and terrorist financing activity being detected.

_________________________________________________________________

You may also like to read:

References:

[1] National Crime Agency, UK Financial Intelligence Unit: Suspicious Activity Reports Annual Report 2020: https://www.nationalcrimeagency.gov.uk/who-we-are/publications/480-sars-annual-report-2020/file#:~:text=The%20UK%20Financial%20Intelligence%20Unit,a%20defence%20(up%2081%25).&text=This%20represents%20a%20116%25%20increase%20on%20the%20total%20January%202019%20submissions – accessed November 2021

[2] The Law Society, ‘Suspicious activity reports’, 3 June 2021: https://www.lawsociety.org.uk/en/topics/anti-money-laundering/suspicious-activity-reports – accessed November 2021